iowa city homestead tax credit

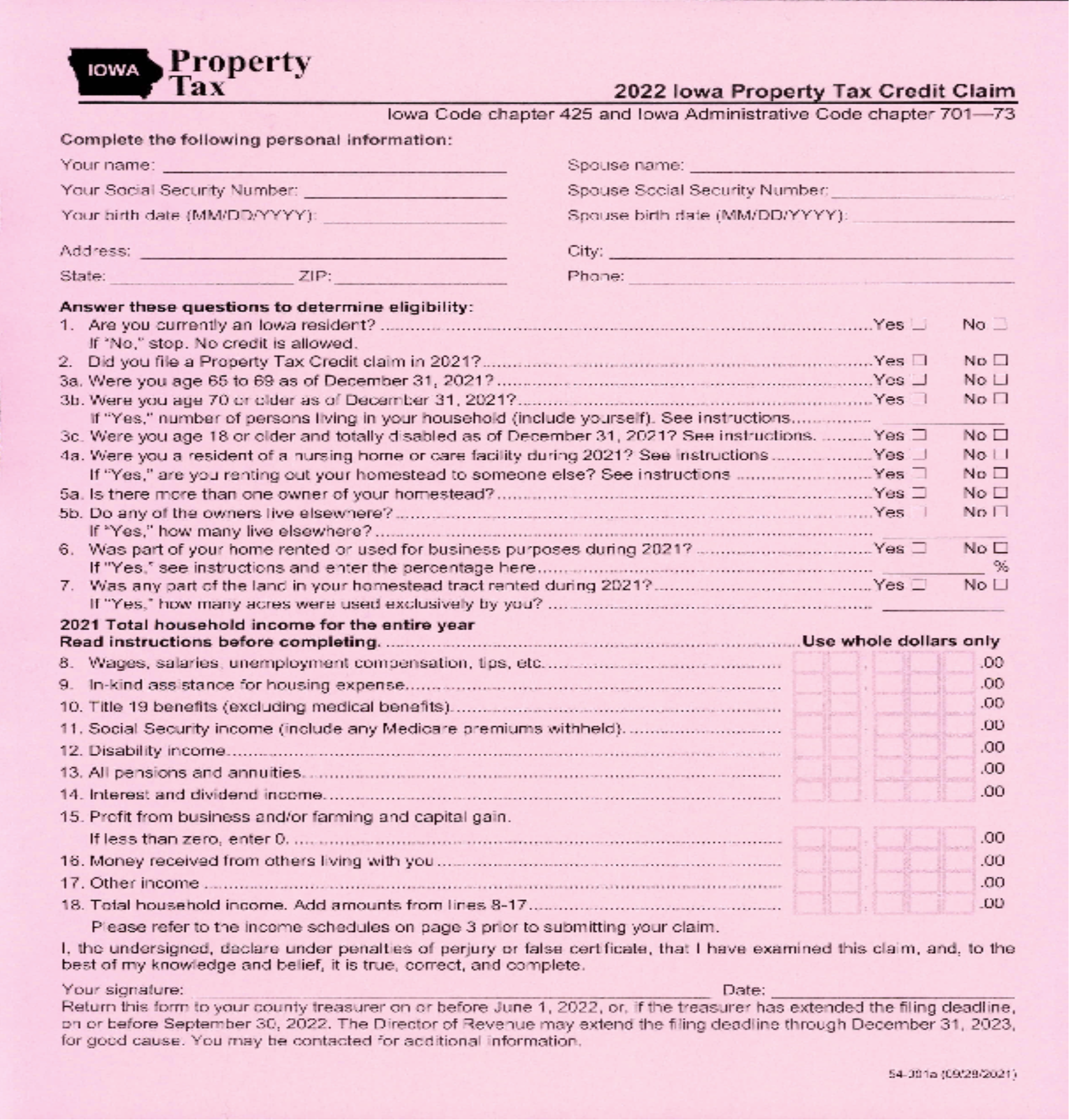

52240 The Homestead Credit is available to all homeowners who own and occupy the. 54-028a 090721 IOWA.

What Is A Homestead Tax Exemption Smartasset

This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed.

. Learn About Property Tax. When it comes to the homestead exemption its up to you to take the initiative. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site.

What is a Homestead Tax Credit. That amount may then be reduced by the county to the same amount at which the State of Iowa has approved funding. It is a tax credit funded by the State of Iowa for qualifying homeowners and is based on the first 4850 of actual value of the homestead.

This exemption is a reduction of the taxable value of their property amounting to a maximum 4850 or the amount. Homestead Tax Credit Iowa Code chapter 425 This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed. It must be postmarked by July 1.

It must be postmarked by July 1. IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor by July 1 of the year in which the credit is first claimed. Adopted and Filed Rules.

The homestead credit is a property tax credit for residents of the state of Iowa who own and occupy their homestead on July 1 and for at least six months of the calendar year. Instructions for Homestead Application You must print sign and mail this application to. Sioux City IA 51101.

Tax Credits. Upon the filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead. Upon filing and allowance of the claim the claim is allowed on that.

Iowa Code chapter 425. To receive this tax credit a homesteader must own and occupy the property for six years prior to July 1 2016 file annual tax returns and reside in. 913 S Dubuque St.

To sign up for the tax credit to take effect for the 2020 assessment year homesteads need to be filed on or before July 1 2020. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. It must be postmarked by July 1.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. File a W-2 or 1099. This application must be filed or postmarked to your city or county assessor by July 1 of the year in which the credit is first claimed.

It is the responsibility of each ownerclaimant to file a homestead tax credit with the city or county assessor on or before July 1 of the year the ownerclaimant is first claiming the credit. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit. To be eligible a homeowner must occupy the homestead any 6 months out of the year but must reside there on July 1.

Iowa Homestead Tax Credit Johnson County Dubuque st suite 217 iowa city iowa 52240. This application must be filed or mailed toyou r city or county assessor by July 1 of the year in which the credit is first claimed. Application for Homestead Tax Credit.

The Homestead Tax Credit is a small tax break for homeowners on their primary residence. If you live in the greater Iowa City area in Johnson County you can apply for the Homestead Credit with a quick visit to the Johnson County Assessors Site. How the Homestead Exemption Works.

To qualify for the credit the property owner must be a resident of. Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Applications can be completed at our office or obtained online by clicking on Additional Information Links above and then the Iowa City Assessor Page.

Homestead Tax Credit Iowa residents who own and occupy their dwelling and the land it is located on may file for homestead credit. NEW HOMEOWNERS--Be sure to apply for Homestead and Military Tax Credits. To qualify for the credit the property owner must be a resident of Iowa and actually live on the property on July.

Iowa Code Section 425. Iowa City Assessor. It is the property owners responsibility to apply for these as provided by law.

In the state of Iowa this portion is the first 4850 of your propertys net taxable value. A tax credit for homestead taxes in Iowa is equal to 4850 in actual taxes in accordance with current policies. Upon filing and allowance of the claim the claim is allowed on that homestead for successive years without further filing as long as the person qualifies for the homestead credit.

If the property you were occupying as a homestead is sold or if you cease to use the property as a homestead you are required to report this to the Assessor in. To qualify you must live in the Iowa property you own for 6 months of the year be an Iowa resident and live in the home on July 1. The military tax credit is an exemption intended to provide tax relief to military veterans who 1 served on active duty and were honorably discharged or 2 members of reserve forces or iowa national guard who served at least 20 years qualify for this exemption.

This application must be filed or postmarkedto your city or county assessor on or beforeJuly 1 of the year in which the credit is first claimed. The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Youll need to scroll down to find the link for the Homestead Tax Credit Application.

Application for Homestead Tax Credit Iowa Code Section 425. Homestead Tax Credit Iowa Code Section 42515 54-049a 080118 IOWA This application must be filed with your city or county assessor by July 1 of the assessment year. Learn About Sales.

Your military DD214 must be recorded in order to qualify. Upon filing and allowance of the claim the claim is allowed on. Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801.

Law. Upon filing and allowance of the claim the claim is allowed on that. It is a onetime only sign up and is valid for as long as you own and occupy the home.

Former members of the service who have served at least 3 years active duty or former members of the service who served during a wartime period or current or former members of the reserves or Iowa National Guard who have served at least 20 years.

Deducting Property Taxes H R Block

Property Tax Relief Polk County Iowa

What Is A Homestead Tax Exemption Smartasset

Here Are The States That Provide A Renter S Tax Credit Rent Com Blog

Property Tax Comparison By State For Cross State Businesses

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

What Is A Homestead Exemption And How Does It Work Lendingtree

Homestead Exemptions By U S State And Territory

Property Tax Homestead Exemptions Itep

What Is Iowa S Homestead Tax Credit Danilson Law

Historic Preservation Tax Credit Iowa Economic Development Authority